How do we define the specific point of time for counting the “first 5 years” when a foreign special professional's salary income exceeds NT$3,000,000 and is eligible for the tax incentives?

The term “first 5 years” in the tax incentives shall start from the year when the foreign special professional has resided in the R.O.C. for 183 days or more for the first time, and has an annual salary income over NT$3,000,000. The taxpayer cannot choose the starting year and applicable years as he/she wishes.

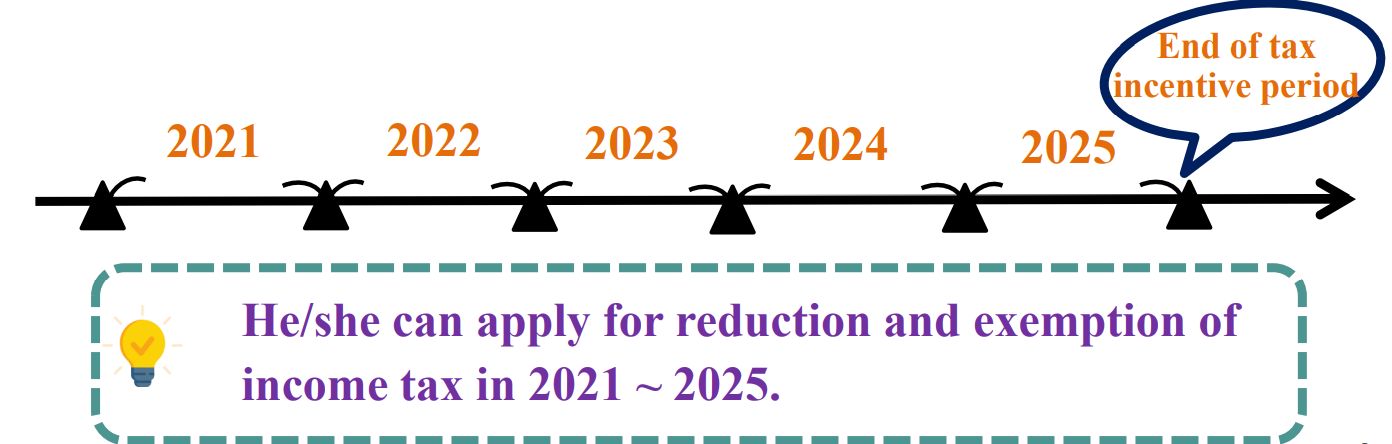

Example of engaging in professional work in the R.O.C. for the first time in 2021:

David, obtaining the foreign special professional employment permit in 2021 and meeting the requirements, stays in the R.O.C. for 183 days or more and has an annual salary income over NT$3,000,000 derived from his special professional work during the years 2021 ~ 2025. Year 2021 is the first applicable year and David can apply for the tax incentives from 2021 to 2025.